You want a stable investment providing a solid return. The Foundation Premium Income Fund is focused on achieving these goals in the current investment landscape.

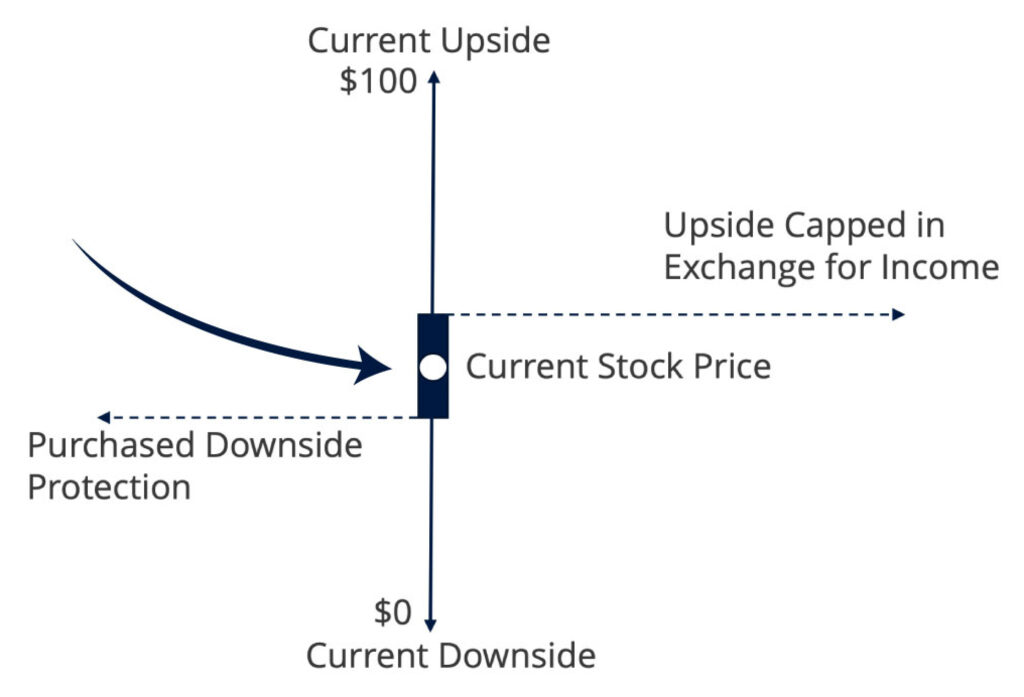

By utilizing options in addition to owning your stock, you as an investor create a more certain range of outcomes for your investment.

As you can see in the diagram below, the opportunity for a more appealing return is greater than with current standard bonds.

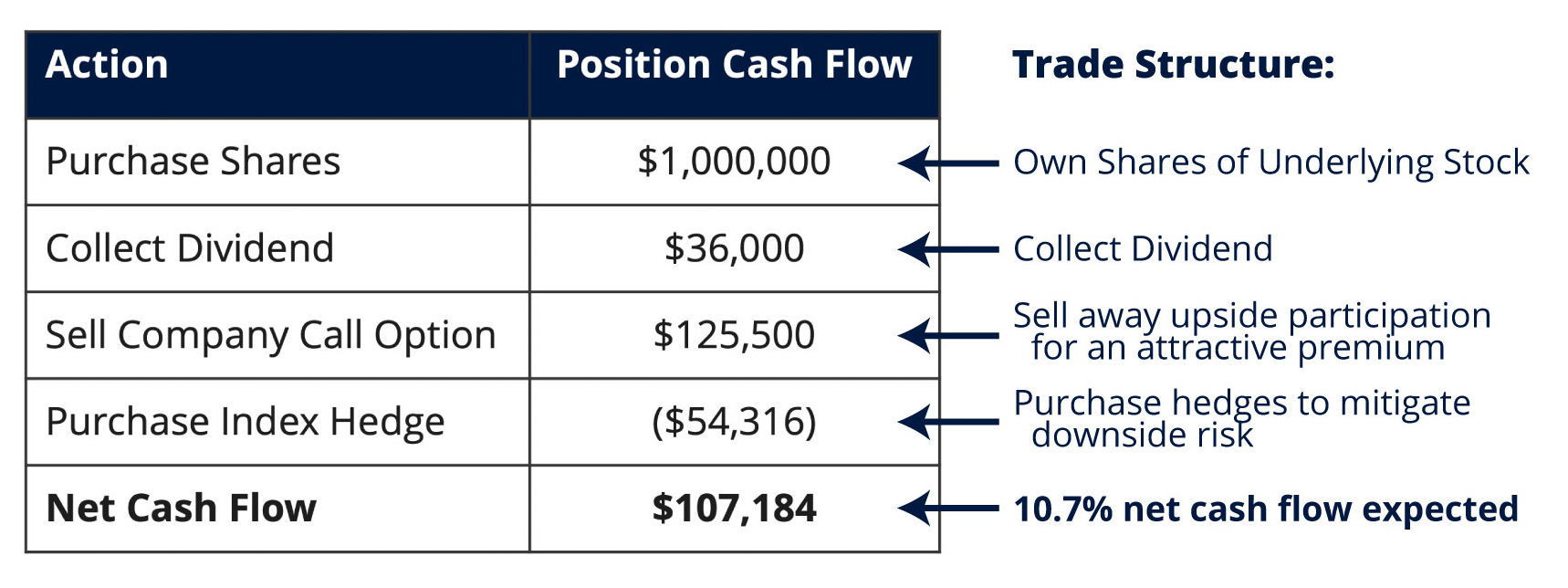

Source: Fidelity Investments as of September 9, 2020. Assumes call options are written approximately at-the-money with expiration as of September 17, 2021. Initial purchase amount rounded to nearest 100 shares.

Assumptions:

Result:

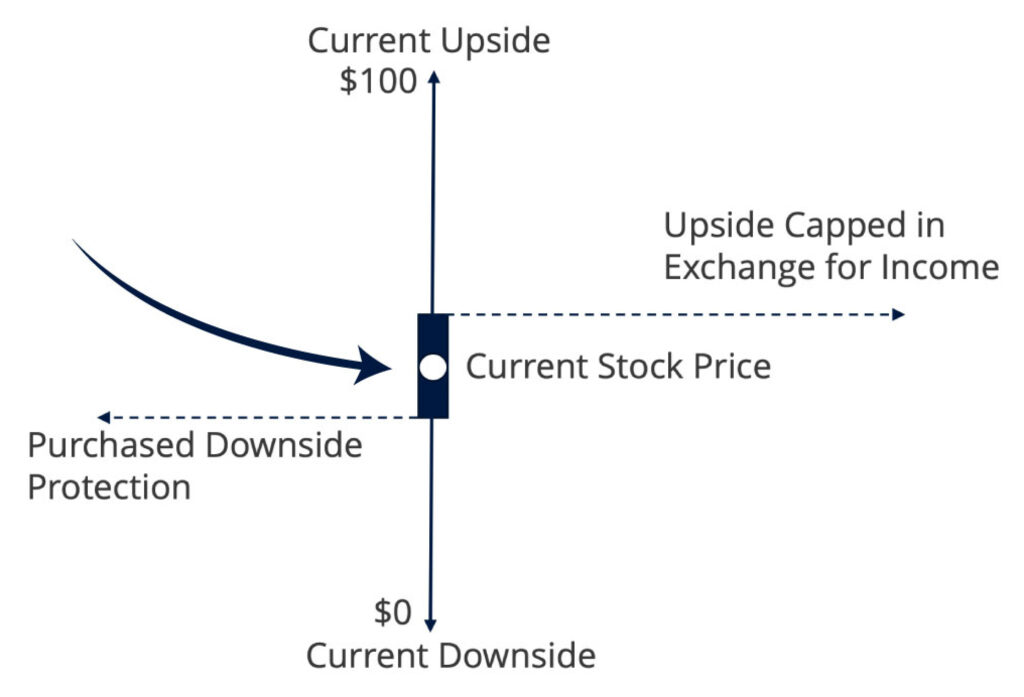

By utilizing options in addition to owning your stock, you as an investor create a more certain range of outcomes for your investment.

As you can see in the diagram below, the opportunity for a more appealing return is greater than with current standard bonds.

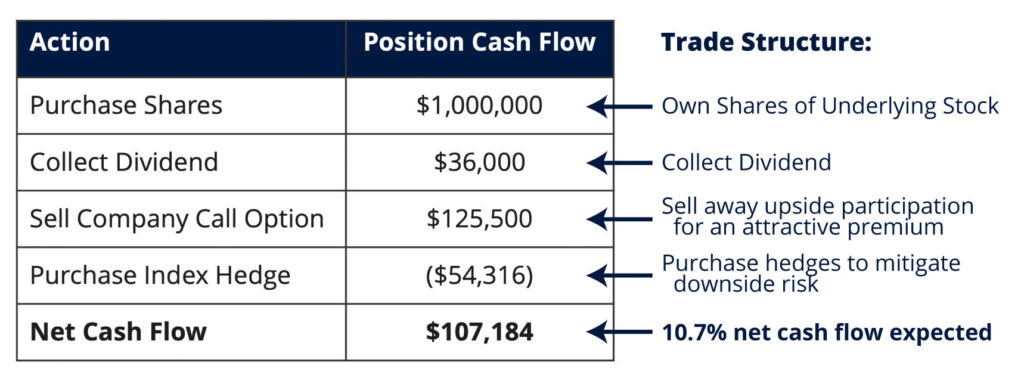

Source: Fidelity Investments as of September 9, 2020. Assumes call options are written approximately at-the-money with expiration as of September 17, 2021. Initial purchase amount rounded to nearest 100 shares.

Assumptions:

Result:

A fund that provides a steady return without excessive risk.

A fund that provides a steady return without excessive risk.