You want to invest in the securities of companies that are leaders in environmental sustainability. The Foundation Green Income Fund is focused on achieving these goals in the current investment landscape.

The Foundation Green Income Fund (FGIF) starts with companies that are helping to build a greener future: Solar and wind farm owners and builders; companies that make electric vehicles, batteries, or charging infrastructure, and their suppliers (amongst many other examples). If the company or its products reduce the use of fossil fuels while paying a well covered dividend, we will consider it for FGIF. From there, we apply traditional valuation screens and our in-depth knowledge of the industry-leading companies to predict these companies’ future role in a more sustainable future. We focus on companies with solid financials and income streams while trying to avoid overpriced, flavor-of-the-moment stocks.

By utilizing the competitive prices on Wind, Solar, and LED technologies and with the increased interest in investment activism, you as an investor can create a more certain range of outcomes for your investment. Enhancing your transition to clean energy through smart investing.

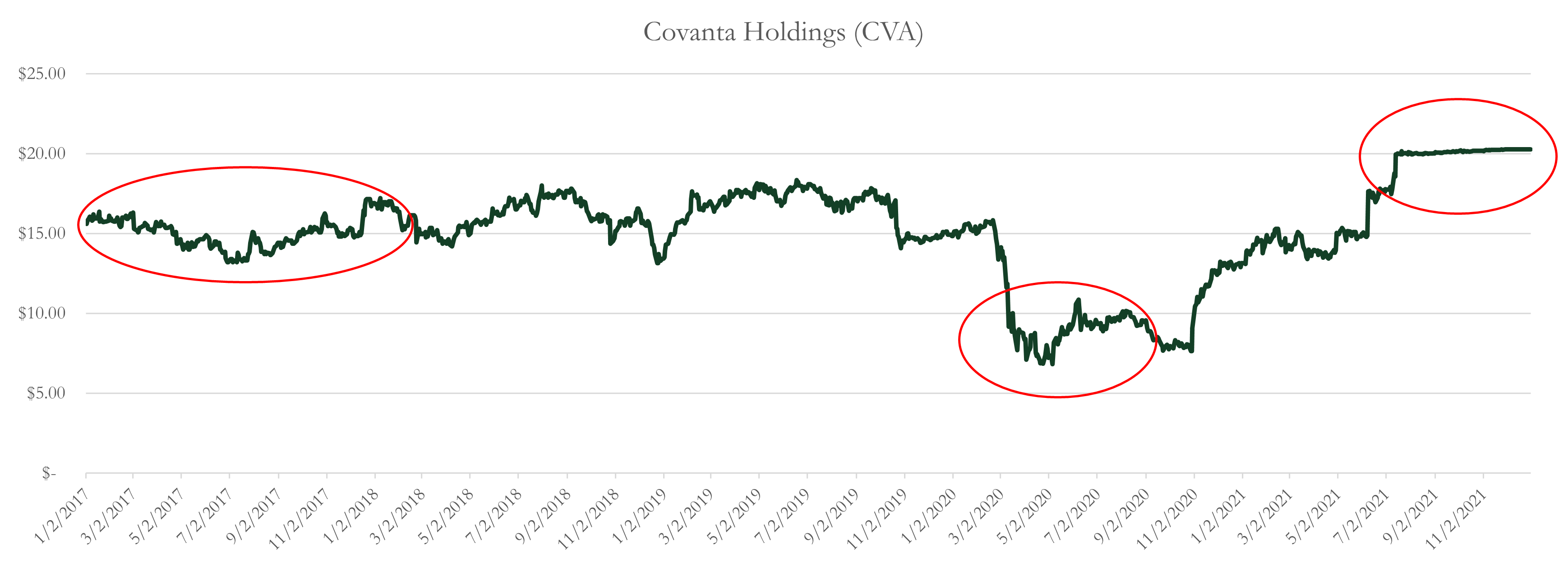

Covanta is a leader in waste-to-energy solutions. The company earns revenue from collecting waste, filtered incineration of waste to produce electricity, scrap metal recovery / recycling, and sale of incineration byproducts for road construction.

The company’s solutions are more environmentally-friendly than landfills in multiple ways.

Dr. Konrad has followed Covanta for more than a decade.

| wdt_ID | Company | Symbol | Net Exposure | Theme | Thesis Summary | |

|---|---|---|---|---|---|---|

|

19 | PowerFleet, Inc. | AIOT | Transportation | Mobile asset management solutions company offering software to help provide data and drive cost / energy efficiencies for owners of large vehicle fleets. | |

|

20 | Cadeler AS | CDLR | Renewable Electricity | Key supplier within the offshore wind industry for installation services, operation, and maintenance. | |

|

21 | Hannon Amstrong Sustainable Infrastructure | HASI | 7.0% | Building Efficiency | A unique renewable energy and energy efficient speciality financier with a flexible business model that has been resilient in a wide variety of market conditions. |

|

29 | NFI Group Inc | NFYEF | Transportation | Manufacturer of transportation systems such as public transit buses. Public transit is inherently more environmentally-friendly than individual vehicles, and NFI may benefit from IRA Act incentives. | |

|

30 | Veolia Environment | VEOEY | 4.4% | The largest water company globally, and the company provides the portfolio with exposure to waste management and renewable energy. | |

|

31 | Rockwool AS | ROCK-B | 1.9% | Building Efficiency | Leading building insulation supplier in Europe. |

|

32 | Brookfield Renewable Corp | BEPC | 6.8% | Renewable Electricity | Owner and developer of operating renewable electricity generation and grid assets and pays a high dividend yield. |

|

33 | NextEra Energy Partners LP | NEP | 12.7% | Renewable Electricity | Owner and developer of operating renewable electricity generation and grid assets and pays a high dividend yield. |

|

34 | Clearway Energy Inc | CWEN | 7.1% | Renewable Electricity | Owner and developer of operating renewable electricity generation and grid assets and pays a high dividend yield. |

|

35 | Umicore SA | UMICY | 5.4% | Recyling | Leading circular materials technology company with processes to extract and repurpose precious metals and inputs to batteries used for electric vehicles. |

| 36 | Total Top 10 Holdings | 6.5% |

By utilizing the competitive prices on Wind, Solar, and LED technologies and with the increased interest in investment activism, you as an investor can create a more certain range of outcomes for your investment. Enhancing your transition to clean energy through smart investing.

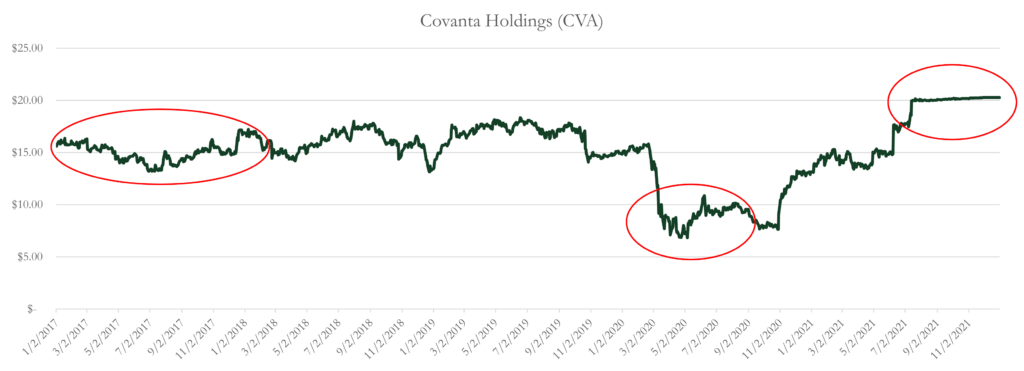

Covanta is a leader in waste-to-energy solutions. The company earns revenue from collecting waste, filtered incineration of waste to produce electricity, scrap metal recovery / recycling, and sale of incineration byproducts for road construction.

The company’s solutions are more environmentally-friendly than landfills in multiple ways.

Dr. Konrad has followed Covanta for more than a decade.

Fund The Change

Fund The Change